Carriers have started announcing blank sailings in an effort to manage capacity. What are blank sailings you might ask? A blank sailing is a sailing that has been canceled by the carrier usually when the demand for space is low in order to ensure that vessels are full. Why blank sailings happen? The Golden Week and the end of the peak season are the main reason why blanks sailings usually happen this time of the year. But this year, blank sailing announcements have peaked more than usual, thanks to the upcoming IMO 2020 regulations. The new regulations have made some carriers pull their vessels out of rotation in order to equip them with scrubbers that will allow vessels to clean fuel, in order to meet the IMO’s low-sulfur requirements.

Transpacific space situation

Due to so many blank sailings in October and the coming winter program from November, the market space to both the U.S. West Coast (USWC) and the U.S.East Coast is quite tigh. November 1st General Rate Increase (GRI) is possible and the rate at least will be maintained for the first week of November. Due to the coming IMO 2020 of December 01st, shippers may move more cargo in November to avoid the cost increase, so it is expected for the carriers to impose November 15 GRI again.

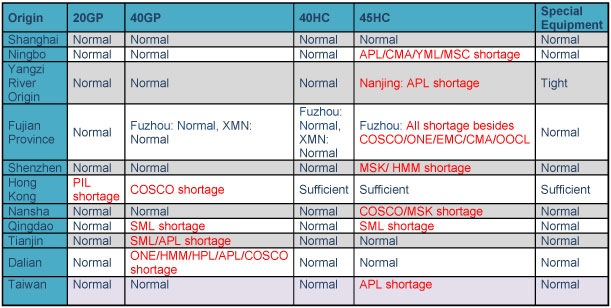

Current Space status in China:

- The current space for both USWC and USEC is tight and some carriers are even over booked until the end of October, especially for USWC.

- Due to so many blank sailings in October, a high number of rolled shipments is expected and tight capacity until the end of October.

- for November, The Alliance has announced the winter program starting on November, two East Coast services will merge into one and the space capacity of their two West Coast services will be gradually downsized.

- Other Alliances might announce a winter program as well. So the market space in November will be surely tight.

Current Space status in South East Asia for Week 43 & 44:

Here is an updated booking status of Indonesia, Thailand, Vietnam and Malaysia.

Vietnam:

ZIM’s space is full & cannot accept bullet Furniture due to low rate.

Happag Lloyd (HPL): open for PN2 (Tacoma & IPI via Canada) & USEC

Thailand:

- APL PG6 to Gulf tight risk to be double rolled.

- ONE’s PN2 & WC EC service space is full, however still accepting bookings but there’s a high risk for the cargo to be rolled.

- Cosco is experiencing a reefer equipment shortage, Cosco’s gulf service HOU,TAM & MIA recommended.

- CMA promote space to EC

- ZIM got more allocation to EC ZNF service 500TEU/W but limit for Z7S only 10TEUs /W.

Indonesia:

Currently carrier average still open for West Coast service, also situation for East Coast is currently normal but still subject to roll over.

Malaysia:

- East Coast space is tight for most carriers.

- APL open for PNW & Gulf but space situation at Pusan is very tight mainly PSW lane, cargo rollings are expected up to 3 weeks starting this week M/vessel.

- HPL open for PNW lane.

- COSCO space for early SEP is fully booked since last month and MSK reported space is tight for both WC/EC due to heavy loading from their BCO.

- Fixed Rate NAC.

Since the current space is full and the situation will be the same in November as well. Carriers might push up the market in November. Carriers will limit the fixed space accordingly. For sporadic shippers, carriers might reduce the fixed space when their space become tight, they will reserve the fixed space for recurring shippers.

Transpacific space situation

- Updated blank sailing summary list:

The Alliance and Ocean Alliance will add some new blank sailings on November and December.

- Transpacific winter service program:

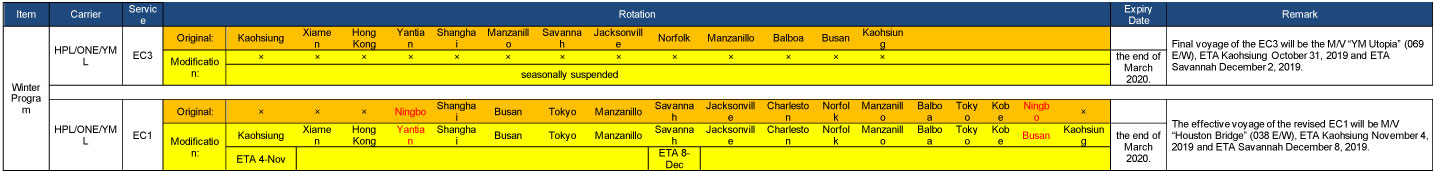

The Alliance will have two East Coast service updates, East Coast 3 (EC3) and East Coast 1 (EC1) during the winter season, those changes will continue through the end of March 2020.

The EC3 service will be seasonally suspended. The final voyage of the EC3 is the M/V “YM Utopia” Voyage 069 E/W with ETA Kaohsiung 31-October and ETA Savannah in December 2nd.

The EC1 schedule will subsequently be modified to ensure continuity of the port pairings formerly provided by the EC3. The effective voyage of the revised EC1 will be M/V “Houston Bridge” Voyage 038 E/W with ETA Kaohsiung 4-November and ETA Savannah 8-December.

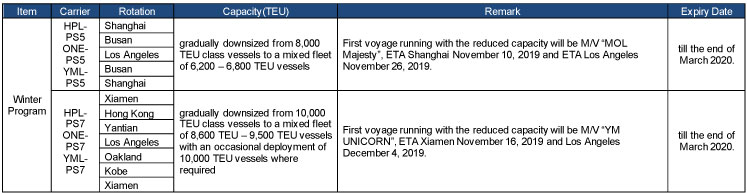

In continuation to the above announced changes to the East Coast services, The Alliance has updated the capacity changes to the Pacific South West (PSW) services without any changes to the current service rotation. This changes will continue through the end of March 2020.

Equipment Situation

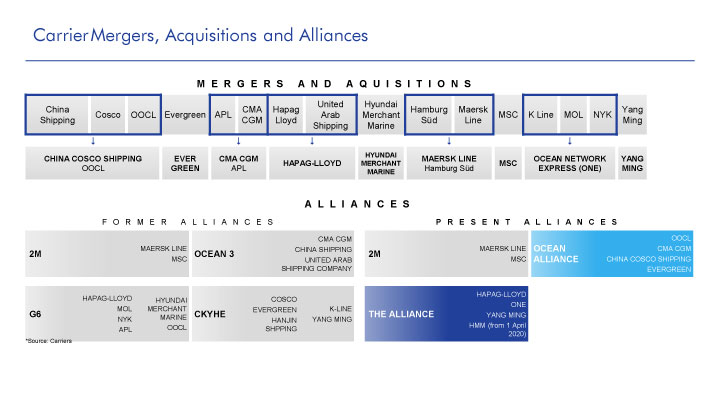

Alliances and merges

Wrapping Up

Review your existing procurement level with service providers to ensure you have enough capacity. Most carriers will look at the minimum quantity commitment and divide by 52, which becomes the weekly space allotment they’ll provide for your shipments. Coordinate the booking of your shipments up to three weeks in advance before the cargo ready date to secure space in the Vessels. There’s no doubt that proactive planning and forecasting can make a big difference surfing this tight capacity situation.