The International Maritime Organization (IMO) is initiating a low sulfur mandate for 2020. As the mandate gets closer, it brings with it significant changes to the container shipping industry. It’s essential to review what shipping knows and doesn’t know as that deadline draws nearer.

Low sulfur mandate

This mandate was adopted in October of 2016, providing refiners, stakeholders, and ship owners just over three years to begin implementing changes so that they meet the sulfur emissions cap for fuels, which was at 3.5%, but as of 2020, will be at 0.5%.

Steps carriers have made with VLSFO

Indications tell us that most of the low sulfur fuel oil supplies are sufficient at most major ports. Major ports like Rotterdam and Singapore have reported compliance on large volumes of available fuel. Refiners are going to have to maximize their production to hit the estimated mark required of 1.4 million barrels per day over the next year.

Carriers have already taken steps to secure compliant fuel long before this deadline approaches.

What prices reveal

The problem lies with the prices. Even though there is a large amount of floating storage on tankers, upwards of 80 million metric tons, the shipping industry doesn’t yet know how much of the reported 80 million mt will be available to the broader market.

The problem again is that prices don’t support the oppinion that there is enough fuel for everyone. Right now, the discount for marine gas oil had reached $13 per metric ton when it was $45 per metric ton back in October. Likely, the floating storage mentioned above is not compliant, has varied origins, and that not all of the projected volume will be made available to the market.

It’s also likely that suppliers are currently in negotiations with bunker buyers, which means that this otherwise theoretically available volume could disappear quietly and confidentially through private trade. At that point, the remaining bunker buyers won’t be able to find fuel, sending prices even higher. There are also concerns about smaller ports along with secondary as well as tertiary trade routes that won’t have a high enough quantity of compliant supply.

VLSFO and HSFO

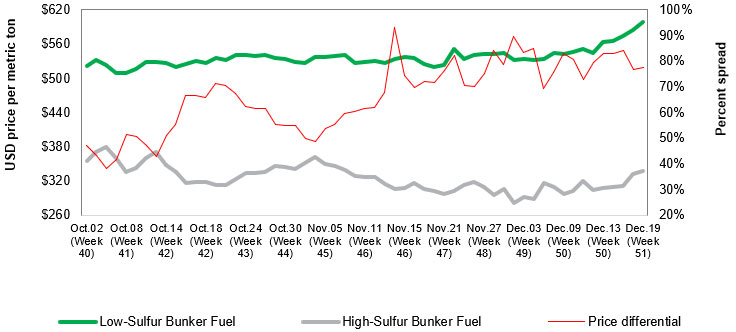

There is a big spread between VLSFO and HSFO, high sulfur fuel oil, at some of the most prominent ports around the world. Right now, the range between the two is approximately $250/mt and $300/mt. In mid-December, in Singapore, this amount was $303/mt, $277/mt in Rotterdam at the same time, and $256/mt in Houston. The spread has increased over late November and December 2019. In Rotterdam, for example, the rate has increased by $53/mt because of the collapse of high sulfur indications and the demand for low sulfur fuel.

Price spread between low-and high-sulfur fuels

Source: Argus Media

By the end of the first quarter in 2020, this spread will likely reach levels between $425 and $450. To meet this new mandate, whether shippers use scrubbers or burn low sulfur fuel; it’s going to add costs to the shipping container industry of 10 – 15 billion dollars.

Why MGO matters

Carriers can burn Marine Gas Oil (MGO), which is a diesel fuel compliant with this new mandate, and it brings with it the critical benefit of being available in a known quantity, which makes it significantly more accessible than other fuels. The downside is it’s also more expensive. To provide 1 million barrels per day, refiners have to increase their production by a factor of 1.7 million barrels per day to meet this demand.

This matters much more when you consider that long-term there are fundamental issues with other available compliant fuels, MGO might become what half of the global shipping fleet ends up using when other supplies fall short. This could take place for at least a year or two after the mandate goes into effect.

For the first few months after the mandate goes into effect, the market will not adjust to the correct levels of supply and demand. When there isn’t enough VLSFO, ship owners will have to turn to MGO, which is already more expensive, but will undoubtedly spike in price as the demand increases.

How scrubbers can help

There exists the option of installing scrubbers. Scrubbers will allow ships to continue burning cheaper fuel with high sulfur but these are still very expensive. The high take-up rate for scrubbers makes them attractive because the current price spread by comparison for low sulfur fuel oil is upwards of $250 per ton, which would give ships a substantial amount of savings compared to switching to the low sulfur fuel option. It’s projected that an average of 1700 vessels already have scrubbers, which is very close to the projection that was made originally for January 1st of having two thousand vessels on the water with scrubbers. The problem is this rush of scrubbers has resulted in significant delays in the shipyards responsible for making the retrofits. On average, it takes upwards of 59 days to install a scrubber, with 17% of ships facing upwards of 80 days. That downtime is costly. It’s going to take a long time to get more vessels fitted with scrubbers, especially given the rush.

How shippers can learn more

Right now, there is still a lot being discussed when it comes to compliance, and analysts agree that no significant carriers are willing to accept the reputational risk of burning non-compliant fuel. This means that the degree to which state authorities punish those who don’t comply and what level of compliance major shippers achieve is something that needs to be reviewed regularly over the next few months. While compliance will be challenging, it might be reached sooner rather than later in some areas. Shippers can learn more by regularly reviewing market data by top analysts.