Supply Chains are complicated. This is a fact of life we accept in the shipping industry. Suppliers, manufacturers, shippers, and logistics professionals have to consider much more than just the transportation leg of their products’ journeys. Perhaps the other biggest single factor in supply chain management concerns storage and warehouse distribution.

In this post:

- Foreign Trade Zones save costs with fewer restrictions

- Why would anyone choose a bonded warehouse?

- When bonded warehouses are a smart alternative

- Side by side comparison of FTZs and bonded warehouses

International shipping changes the game

Those new to the field might think there’s not much to discuss. Build a warehouse or rent space at an existing one, drop your goods off, and move on.

In reality, there are many more decisions shippers must make regarding warehouse usage in order to optimize their time and save money. The continued increase in international trade only solidifies the importance of this statement. More and more, companies are manufacturing goods in China or other East Asian countries, sending them somewhere else for assembly or storage, and then ultimately distributing them to countries far and wide across the globe.

This complicated system caused shippers to run into all sorts of problems. Running the numbers regarding where it is most cost effective to manufacture, assemble and disassemble, organize, sort, distribute, store, and sell products is difficult enough to give anyone a headache – and that’s even before taking into account the costs of schlepping cargo in between all these locations.

Foreign Trade Zones save costs with fewer restrictions

Enter the Foreign Trade Zone. Abbreviated as an “FTZ,” these special regions have become the saving grace for many international shippers. Interestingly, an FTZ in the United States isn’t technically considered part of the U.S., and the same goes for zones in any other nation. Of course, this doesn’t mean FTZ’s are subject to anarchic chaos, lacking any supervision from a controlling government. But it does mean they provide a few attractive perks to budget-conscious shippers.

For example, goods entering an FTZ in the U.S. aren’t subject to customs inspection when they enter the zone – only when they leave it. In addition, shippers don’t have to supply a bond to store their goods in an FTZ, nor do they have to pay duties on their cargo (unless they plan on distributing them within the United States for consumption). Shippers can store both foreign and domestic goods in a Foreign Trade Zone, and neither type of shipment is subject to tax (again, unless the domestic products are intended for distribution within the country).

Companies whose products require many stages of manufacturing and assembly can also take advantage of Foreign Trade Zones. This is because they can manufacture goods within the FTZ without paying duties on waste materials or other associated costs, such as labor or overhead. What’s more, they only need to pay duties on either the imported goods or final product – whichever is cheaper! Not only that, but the manufacturers can actually choose whether or not to pay tariffs when the goods enter or leave the warehouse, and again, companies typically pick whichever method will secure them the lower price.

The list of advantages for FTZs goes on. Companies can store goods for an unlimited period of time in these zones, and can take an almost unlimited number of actions within the region, including sorting, destroying, cleaning, grading, mixing, labeling, assembling, manufacturing, exhibiting, selling, and repacking their products. Logistics professionals enjoy 24-hour control over their goods, moving products in and out of the zone with very few restrictions.

Why would anyone choose a bonded warehouse?

It’s easy to see why so many international shippers are turning to Foreign Trade Zones to shave costs off their supply chain. Florida boasts more than 20 FTZs, including multiple in Miami. But what’s the alternative? Obviously, not everyone uses Foreign Trade Zones for their distribution needs. Shippers must weigh the pros and cons of operating within these semi-independent zones, and in some cases they might find that it’s easier to stick with traditional, bonded warehouses.

Bonded warehouses operate on U.S. soil and under U.S. jurisdiction, and so understandably are associated with typical customs, duties, and tariffs costs. Shippers can only place foreign goods, imported from other countries, in a bonded warehouse, and are much more limited in their control over such products. For example, they can’t manufacture, assemble, or exhibit goods in the warehouses; they can only clean, repackage, and sort them – under customs’ supervision. On that note, customs has primary control over goods stored in a bonded warehouse, and so shippers can really only access their own products during regular working hours.

When bonded warehouses are a smart alternative

It might seem like bonded warehouses come with too many restrictions and red tape, but shippers who plan on selling goods domestically won’t benefit much from using Foreign Trade Zones instead. The benefits of FTZs mainly apply to shipments that will ultimately end up back in another foreign nation for sale. Shippers who rely heavily on the domestic marketplace for retail will need to study the ins and outs of bonded warehouses, and learn how to deal with customs officials appropriately!

Fortunately, there are a few hundred bonded warehouses in Miami Dade County alone. This means that shippers transporting manufactured goods into the U.S. from other countries will have more than enough room to store their shipments. As long as they operate on an efficient schedule, they only need to keep their inventory in a warehouse for a short period of time. Of course, the sooner they can get their goods back on the road and into the arms of eager buyers, the more money they’ll make!

If you’re interested in applying to become an FTZ Subzone in Miami, visit MiamiDade.gov/PortMiami.

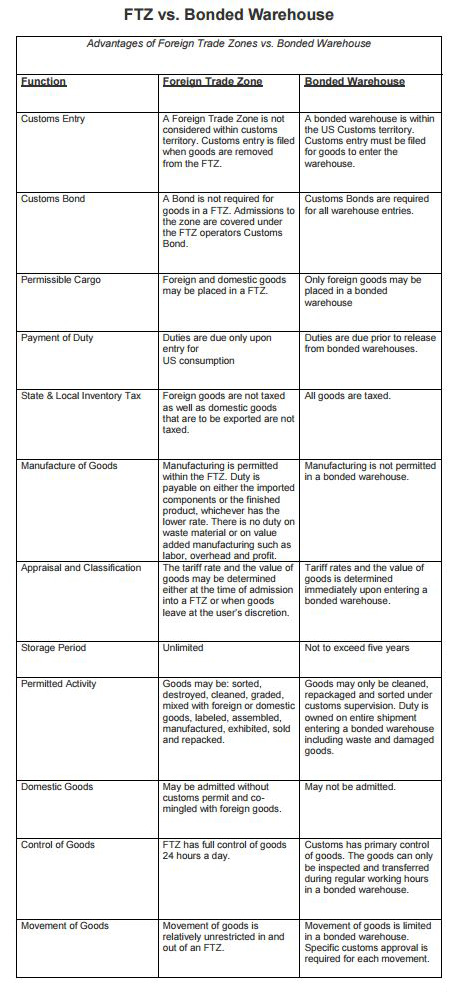

Side by side comparison of FTZs and bonded warehouses

PortMiami created this simple side-by-side comparison highlighting the differences between a Foreign Trade Zone and a bonded warehouse. It is worth noting that while the comparison is biased towards FTZs, it is still a great resource for quickly comparing the two options.

View the PDF from PortMiami here.

12 Comments on “Head to Head: Foreign Trade Zones vs. Bonded Warehouses”

hello Ashley

it’s so glad read above your wirte , very good , hope both of us are able to establish for a long term to cooperation relation in future . skype id: amoupll

B.rgds

Andy

Thank you, Andy! Glad you enjoyed the article.

Ashely you forgot to mention the summary entry program which allows shippers to pay weekly under one entry for all goods that enter the commerce of the US. By doing so you pay only one Merchandise Processing Fee (MPF) which caps I believe at $485. See below:

20 Inbound receipts per week. MFP = $9,700

Annualized MPF = $504,400

75 Shipments out per week, one entry filed, MPF= $485

Weekly potential savings $9,215 annual savings $479,180.

Also if my imported goods carry a duty but my finished product does not, I pay ZERO duty at entry.

Best,

MF

Michael – you bring up a good point. Thank you for the breakdown of potential savings.

This is wonderful analysis.

Thank you, Eric!

Hi…Ashley,

Very good article, helps me a lot to understand the fundamental difference between FTZs and bonded warehouses.

Hi Mayank – glad the you found the article helpful!

Hi,

I don’t understand about MPF. Is it for FTZ or Bonded warehouse?

Thanks.

Hi Blake – The Merchandise Processing Fee (MPF) is a fee imposed by U.S. Customs and Border Protection (CBP) for most U.S. imports.

The MPF is charged at 0.3456% of the value of the merchandise being imported. There is a minimum fee of $25 and a maximum of $485 for formal entries. We hope this helps

Hi can you please comment on whether or not you can file weekly summary entries on bonded warehouse? I understand that you can do so on FTZ.

Thanks

Hi Ping – Weekly summaries are only for cargo that is on an FTZ, Thank you for reading us.