The decline in the Trans-Pac spot rate is a sure sign that the industry is going to face a lot of challenges in the foreseeable future. The eastbound route has been experiencing falls in import volumes. Most cargo consolidators are of the view that things are only going to get worse in what Nelson Cabrera CEO of ShipLilly describes as a “colossal trade slump”. This has been dubbed the worst September in over two decades, and the volumes are not really where they need to be.

Statistics of the decline

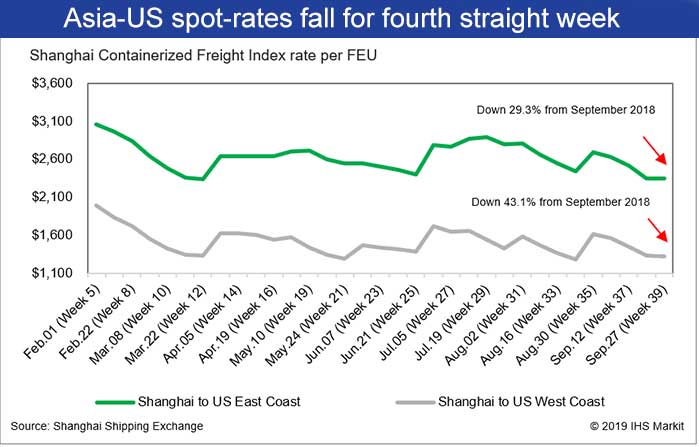

For the fourth straight week, the spot rates in the Asia-USA trade suffered a significant decline. The Shanghai Containerized Freight Index (SCFI) released some statistics which indicated that the East Coast rate was 29.3% lower than a comparable 39th week in 2018. The figures are even worse for the West Coast rate, which has declined by 43.1% when compared to the same month last year. Non-vessel-operating common carriers (NVOs) are also forecasting a continued decline in rates. Some have suggested that the decline will continue right up to the end of 2019. One of the responses to the fall has been to blank sailings. For example, it was reported that carriers had eight blanked sailings to the West Coast. Another two to the East Coast were also blanked.

What caused the decline?

The decline in the Trans-Pac spot rate is directly linked to low demand, which has been the case throughout the month. Most analysts do not anticipate any significant recovery in the foreseeable future. Christian Sur of Unique Logistics International commented that:

“Demand has been weak pretty much all month. There will be no recovery in rates that we see anytime soon. Volumes are really, really soft. People don’t realize how weak they are”.

For example, this week’s spot rate from Shanghai to the East Coast was $2,346 per FEU. This is down 0.2% from last week. The West Coast rate of $1,328 per FEU, and this was down 0.7%. On the 30th of August 2019, the East Coast rate was $2,691 per FEU, and the West Coast rate was $1,615. This is atypical of how the season is usually supposed to progress at this time of the year when there are expectations of higher rates and more significant volumes. Rather than increasing from week to week as they usually do in the peak-season month of September, spot rates have declined for four consecutive weeks. The rest of the industry is taking notice, and there is a knock-on effect all across the board.

What experts are saying

According to the experts, the main reason for this decline is the long standing trade war between the USA and China. This trade war has directly affected the industry through tariffs, which mean that import volumes this summer have not been able to gain any traction as they usually do with back-to-school and holiday merchandise. PIERS reports that US containerized imports from Asia declined 0.1% in June, increased 4.7% in July, and increased 1% in August year over year. Moreover, retailers expect an uneven performance in the coming months. The latest Global Port Tracker report indicates that US imports are projected to decline by 5.5% in October, increasing 8.8% in November, and drop 9.8% in December when compared to 2018. Sur is one of the experts that foresee problems with a volatile rate: “I don’t think anyone wants that…The carriers aren’t going to get more cargo by lowering rates. They’ll just retain what they have.”

Through experience, the trade has understood that other lines will also match a lowering of rates by carriers to compete. Therefore, it makes sense to hold onto cargo until one can find the best deal possible in this buyer’s market. Hence, the trade lane that initially lowered the rates does not end up increasing its volume. Therefore, NVOs anticipate carriers will reduce capacity further in the coming months. Either blanking sailings will achieve this or suspending some weekly services. All these measures mean that there is a decline in business activity. Carriers usually don’t delay services until the slow period that follows the Lunar New Year celebrations when factories in Asia close for a couple of weeks. Lunar New Year 2020 falls on the 25th of January. However, we are already experiencing patterns that indicate a downward movement in volumes.

How this affects shippers

Shippers would usually prefer stable pricing when compared to the situations when the prices are fluctuating wildly. This has been somewhat different in as far as carriers have other options. For example, they can remove some vessels from service in this period running up to the end of the year. Such a move makes sense in light of the transition that is taking place in the industry as carriers switch to low-sulfur fuel. This is a move that is meant to comply with the International Maritime Organization’s (IMO’s) 2020 mandate that takes effect on the 1st of January 2020. Vessels will be dry-docked for a week to flush out the high-sulfur bunker fuel that is still being used so that it does not mingle with the new low-sulfur fuel.

Had cargo volumes been as strong as they usually are at this time of the year, carriers would replace each vessel that is dry-docked for a week with another from their fleets. However, given the soft market conditions in the eastbound trans-Pacific, carriers may choose to blank those individual sailings. This is a natural response to a market that shows every sign of being on the negative side.

Some industry analysts have speculated that importers may front-load shipments that would normally enter the country in January or February to get ahead of higher bunker fuel surcharges after the 1st of January 2020. Others like Bennett argue that there will be much front-loading in November and December 2019. Customers are holding off booking until they are more certain about the rates. That cannot be good for the industry.