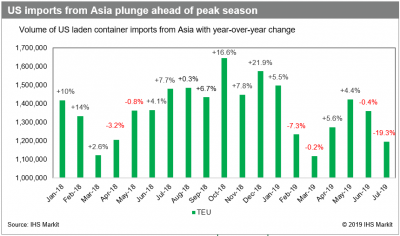

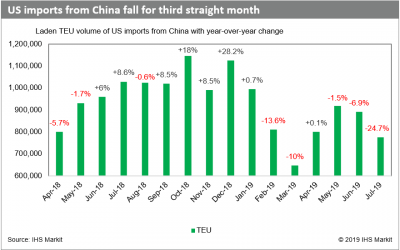

The Trump administration has issued more tariffs, between 10-25% on over $250 billion worth of imports from China in 2019 alone, which has resulted in a plunge in U.S. imports from Asia. Statistics comparing import data from this year to the same weeks and months of last year showed declines that are hitting West Coast ports the hardest. Unfortunately, those declines are scheduled to continue.

The Data on U.S. Imports from Asia this Year

Thus far a 19% plunge was recorded last month, signaling weak peaks during a time of the season that should be the highest peak. Analysts are predicting continued issues in spite of a slight uptick between August and October – a traditionally busy time. Eastbound spot rates coming from Asia to the West Coast have fallen 7.2% from the week prior. According to the latest data, the rates hovered at 28.7% lower than the same week last year. These statistics indicate that most of the ships leaving Asia for the first 3rd of August were simply not full. Overall U.S. Imports from Asia were at 19.3% in July, significantly lower than the same week last year.

Effects on the East Coast

The effects have been felt on the West Coast and the East Coast. The West Coast ports have experienced the brunt of this decline with total Imports dropping 2% in the second quarter but the Imports through the East Coast ports have increased 7%. So while the West Coast ports are hit the hardest by these new administrative decisions the East and Gulf Coast ports remain largely unaffected within the second quarter. Right now analysts are unsure whether this increase on the East Coast ports is the result of last year’s front-loading of imports or other factors. This front-loading was done in an attempt to avoid higher tariffs. Comparisons of year-over-year monthly data show that the eastbound trans-pacific Imports saw a slight jump from January 2018 to January 2019 of 5.5%, but February saw a decline of 7.4% and March saw yet another drop of 0.3%.

Analyst Forecasts for Peak Season

The months of August to October are the peak season for imports from Asia. With China accounting for over 70% of the imports that come from Asia, the changes within this administration have caused a sharp decline. Imports are stipulated to continue falling because of the remaining 10% tariff on yet another 300 billion dollars worth of imports that is set to go into effect on the 1st of September. As of now, imports from China are already down 24.7%.

Wrapping Up

Overall, these reports indicate a devastating impact on trade, specifically with Asian imports from China. Containerized Imports based on dollar value have declined 10%, and such declines are scheduled to continue dropping, which will only worsen this already precarious situation.